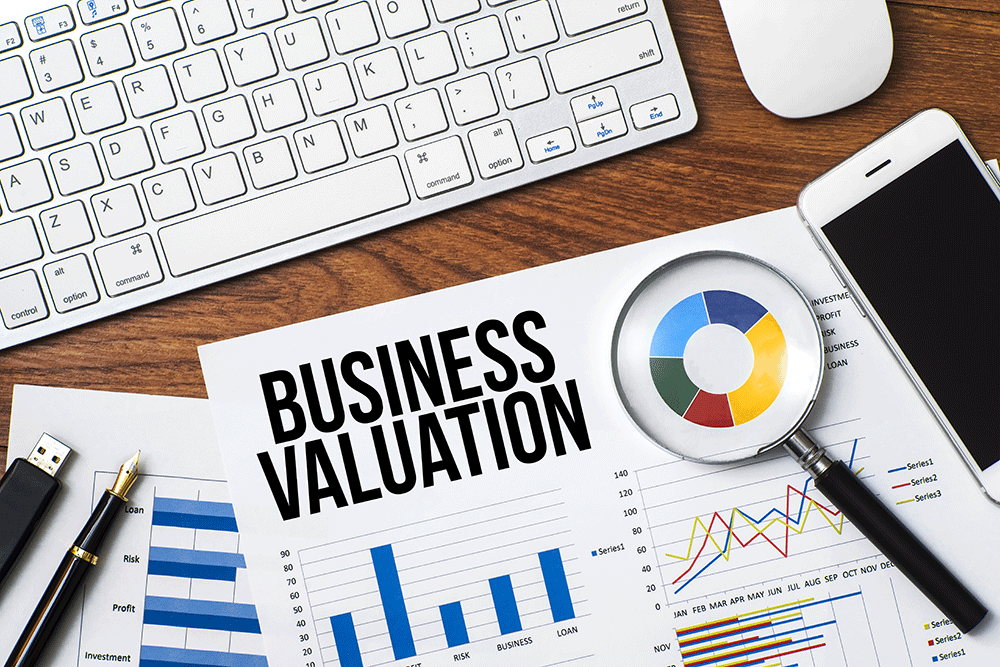

We believe financial statements give the true picture of the health of the company and therefore we emphasize on building a comprehensive financial model with valuation metrics using various established methodologies. We offer a customized and flexible financial model, built with multiple scenarios/sensitivities to incorporate all the future possibilities.

- Comprehensive financial model and assumption validation

- Business valuation (DCF, DDM, SOTP)

- Comparative multiples based models

- LBO analysis

- Model update

- Database linked valuation

- Capital structure analysis

- Sensitivity analysis

- Return analysis

Who we serve

Brokerage and Trading Firms

Asset Management Companies

Hedge Funds

Mutual Fund Managers

Benefits

- Reduced research cost

- Focus more on high value core activities rather than mundane tasks

- Greater flexibility to right-size organization

- Ability to scale research universe on demand

- Source in-depth analysis across industries and geographies

- Quality output, produced by SOP-driven approach and multiple quality checks

Our Value Proposition

Flexibility

Process Improvements

Independent View

Cost Reduction

Engagement modelExclusive attention. Absolute transparency.

Dedicated Model

(Resource Augmentation)

Leverage our dedicated team of analysts who work as an extension of your own team for a mix of regular and ad-hoc research needs.

Bespoke Projects

(Project-based Assignment)

Engage us for project-based research needs for ongoing deals, one-off project or short-term resource ramp-up on demand.

On-demand Model

(Block of Hours)

Get dedicated hours for the year/month as per your requirement to deploy on-demand resources.